“The Great Decoupling” of Taiwan and China in 2024

A Geopolitical Flashpoint: Shifting Social, Economic, and Political Dynamics Amid Rising Cross-Strait Tensions.

Friendly Reminder: Don’t forget to read Part I first

Key Insights (TL;DR):

Cracks in the Silicon Shield: Taiwan's semiconductor industry, led by TSMC, is crucial to the global economy. The geopolitical tensions and economic decoupling between Taiwan and China threaten Taiwan’s "Silicon Shield," potentially causing global disruptions and increasing conflict risks.

Economic Crossroads: Taiwan is reducing its economic dependence on China, leading to a significant shift in trade and investment patterns. This decoupling has resulted in increased trade with the U.S. but has also led to unemployment woes and economic instability within Taiwan as companies move operations to other regions.

A Lost Generation: The offshoring of manufacturing jobs and the focus on high-tech industries have led to high youth unemployment and rising wealth inequality in Taiwan. The oversupply of college graduates and stagnating real wages exacerbate these issues, creating economic challenges for the younger generation.

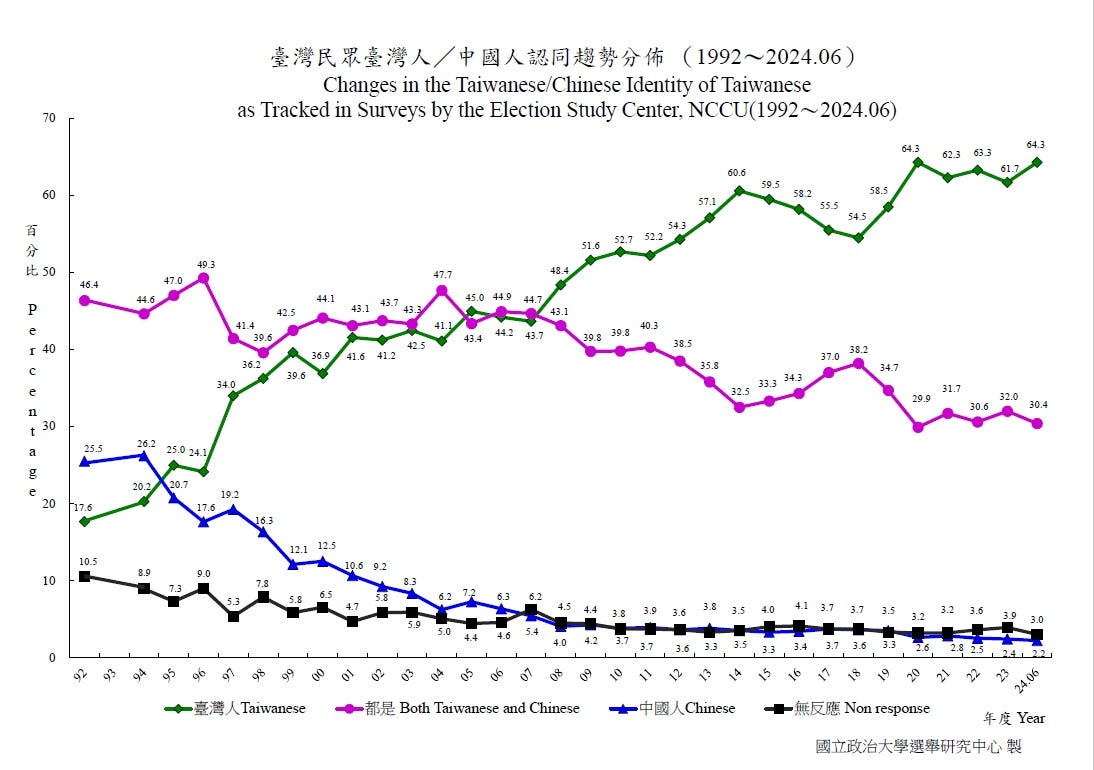

Polarizing Public Opinion in Taiwan: Public sentiment in Taiwan is divided, with a significant majority supporting the status quo in cross-strait relations. However, there is a growing trend, especially among younger generations, toward supporting independence, which complicates the island's geopolitical stance.

International Support and U.S.-China Perceptions: Taiwan has garnered increasing international support, particularly from the U.S. This support includes legislative measures and diplomatic efforts to bolster Taiwan's defenses. Meanwhile, U.S. public perception of China has deteriorated, influencing geopolitical dynamics and increasing tensions in the region.

Cracks in the Silicon Shield

Taiwan’s dominance in semiconductor manufacturing, mainly through Taiwan Semiconductor Manufacturing Company (NYSE: TSM), is mission-critical to the global economy. Any disruption caused by a conflict would have severe repercussions worldwide.

Moreover, the interdependence of the advanced technological supply chain forms a mutual deterrence, a Silicon Shield, against conflict, as first introduced by Craig Addison in the early 2000s (Addison, 2001).

However, the accelerated decoupling of Taiwan and China's economies in the last couple of years due to geopolitical tensions, trade wars, and shifts in global supply chains has significant implications for the semiconductor industry and the broader economic landscape.

In recent years, the CHIPS Act and the U.S.'s concerted efforts to reshore semiconductor manufacturing capabilities have increased conflict risk and Taiwan’s strategic vulnerability.

Moreover, the U.S. continues to propose further targeted restrictions on China, such as banning investments in microelectronics, quantum computing, and AI (U.S. closer to curbing investments in China's A.I., tech sector | Reuters).

By banning Taiwan’s ability to invest and sell advanced technology in China, the U.S. compels semiconductor giants like TSMC to do business only with the U.S. and its allies. Essentially, these policies align Taiwan’s interests with those of the U.S.

The most publicized is the TSMC Arizona facility, which is a vital component of the U.S. strategy to bolster its semiconductor supply chain — costing over 40 billion USD. Along with TSMC Arizona, major fabs, including Intel, Samsung, and Micron, are expected to be fully operational by 2028/29.

The U.S. expects to achieve “Semiconductor Sovereignty” by around 2030. Through enhancing substantial domestic production capabilities to produce over 20% of the world’s leading-edge chips, the U.S. seeks to reduce dependence on foreign supply chains (the U.S. aims for chip supremacy from zero to 20% by 2030).

Historically, economic interdependence has been a deterrent to conflict. However, Taiwan and China's economic decoupling, especially in critical semiconductors, increases the likelihood of conflict, as both sides are less reliant on each other.

Additionally, China perceives the U.S.’ reshoring efforts as a threat to its technological ambitions, potentially prompting more aggressive actions in the near future.

Economic Crossroads: Corporate De-Risking and the Impact on the Workforce

Fact: Taiwan is increasingly decoupling from China.

The impact of diplomatic breakdowns has led to a dramatic drop in trade with China, decreasing by over 20% in 2023 alone (Forbes). Imports from China also fell by 16.41% in 2023 (University of Nottingham).

Unsurprisingly, trade with the U.S. increased by a dramatic 65% increase in March alone (compared Y-o-Y). In Q1 of 2024, the U.S. overtook China as the leading export destination for Taiwanese goods, with over US$26.625 billion worth of exports shipped to the U.S. in the first quarter, beating the US$22.407 billion sent to mainland China for the first time in nearly two decades (Taipei Times).

Due to the increasing “pro-independence” agenda and US-friendly government under Tsai’s DPP government, China has used economic measures, including trade restrictions and financial coercion, as leverage against Taiwan.

In turn, Taiwan has sought to reduce its economic dependence on China and strengthen ties with other countries, particularly the United States.

Although often viewed positively, this has also weakened Taiwan’s economic stability, as high-profile corporations have increased the offshoring of many of their manufacturing facilities to India and Southeast Asia as part of Tsai’s “New Southbound Policy,” announced in 2016.

Taiwanese investment in China has also significantly declined over the past decade. In 2023, it was around $3 billion, one-third of the amount ten years earlier in 2013. This decline in investment, in conjunction with declining trade, reflects a shift towards diversifying investments to reduce economic dependence on China.

In the hushed corridors of Taiwan's business world, consultants and executives discuss the most significant corporate risk faced by Taiwan’s business leaders – geopolitics.

To hedge against geopolitical tensions, Taiwanese companies, including industry leaders like Garmin, Quanta, and Foxconn, are increasingly moving manufacturing facilities to Southeast Asia and India.

Foxconn, the producer of Apple’s iPhones, has significantly invested in northern Vietnam. By 2025, it plans to have 30% of its production outside China (Global Taiwan Institute).

The increase in sanctions and trade wars has also accelerated this decoupling. Companies outside the semiconductor industry have also chosen to move manufacturing facilities overseas.

Non-tech industry leaders, such as Pou Chen Group, a manufacturer of household names such as Nike and Adidas, have already ramped up production in India. China now represents only 10-20 percent of its output (Global Taiwan Institute).

As Taiwan reduces its economic ties with China and strengthens its alliances with the U.S. and other democracies, the risk of conflict increases.

A Lost Generation: The Widening Inequality

While diversifying the supply chain and investment can enhance resilience, it poses challenges for Taiwan's local economy. Over time, the offshoring of manufacturing facilities could lead to increased job losses and reduced economic activity within Taiwan.

The long-term impacts of this decoupling on Taiwan’s domestic economy and workforce are not yet 100% clear.

The prospects are already increasingly bleak for the younger generation, many of whom have historically sought their fortunes in (or from) China.

In early 2024, Taiwan is already experiencing a significant issue with youth unemployment. The unemployment rate for individuals aged 15-29 is 11.42%, which is over three times higher than the overall unemployment rate of 3.34% (Taiwan Gov). This high rate indicates the increasing difficulty young people face in finding jobs.

The oversupply of college graduates in Taiwan has resulted in a surplus of "over-educated" workers struggling to find relevant and well-paid jobs due to a mismatch between their skills and the local economy's needs (Global Taiwan Institute).

Despite Taiwan's robust economic growth, real wages have stagnated and even decreased in certain sectors.

According to the Directorate General of Budget, Accounting and Statistics (DGBAS), average real regular wages in Taiwan's industrial and service sectors have decreased for a third consecutive year in the first quarter (2024)(Focus Taiwan).

This stagnation has been accompanied by an increase in the Gini coefficient, which indicates rising wealth inequality (Focus Taiwan). The explosive growth of A.I. and tech stocks has disproportionately benefited the affluent, exacerbating the wealth gap.

Furthermore, the increased offshoring of manufacturing jobs and overreliance on high-tech semiconductors could limit the diversity and resilience of the local economy, potentially making the economy more susceptible to market shocks.

Taiwan to the World? Or Washington to Taipei?

Polarizing Public Opinion in Taiwan

Public sentiment in Taiwan remains divided, a critical factor in the island's geopolitical stance. The DPP’s continued electoral success suggests a strong, yet weakening, domestic policy mandate— despite Beijing’s opposition.

While research published in 2023 showed a growing trend toward supporting independence(Chen, Wang, Yeh, 2023), the most recent surveys indicate that most Taiwanese prefer maintaining the status quo in cross-strait relations.

According to a more recent 2024 survey, more than 80% of Taiwanese support maintaining the current status quo, with a significant increase in those favoring the indefinite preservation of Taiwan's current status (CNA).

However, there remains a growing trend toward supporting independence, particularly among younger generations (Global Views).

Propping Up an International Narrative

Taiwan has received increasing international support, particularly from the United States and its allies. This support includes legislative measures to bolster Taiwan’s defenses and diplomatic efforts to include Taiwan in international organizations (MOFA, Taiwan Today).

Following The Economist article, the number of articles circulating on the web and social media has increased. Since then, there has been a surge in content depicting Taiwan as a strong democracy capable of resisting external pressures (NYT).

The “mainstream” narrative seeks to garner international support and reassure Taiwanese citizens about their country's stability and security.

While the increased media coverage has brought much-needed attention to Taiwan, it often oversimplifies the complex realities of the island's situation.

The risk of political co-optation is high, where the narratives serve broader geopolitical agendas rather than focusing on the nuanced perspectives of the people of Taiwan (CW).

“China”: The U.S. Public “Enemy” No. 1

The rapid change in the U.S. perception of China is worrisome. Since 2021, the percentage of people who viewed China as “the enemy” increased from 25% to 40% in 2024 (Pew).

The 2024 Pew survey found that 82% of Americans believe China has at least a fair amount of influence on U.S. economic conditions, with 79% viewing this influence as unfavorable (Pew Research Center: Americans Remain Critical of China).

According to other sources, such as Gallup, only 15% of Americans viewed China favorably in 2023, marking a record low and a significant decline from 53% in 2018 (Gallup: Record-Low 15% of Americans View China Favorably).

This shifting perception is influenced by various factors, including geopolitical tensions, economic competition, the COVID-19 pandemic, China's human rights record, and foreign policy.

The Pelosi Turning Point

The visit of Nancy Pelosi, the highest-ranking U.S. official in over a generation and the first Speaker of the House in 25 years, set a dangerous precedent in the eyes of the CCP. Despite warnings from both China and her own government, Pelosi and her delegation landed on August 2nd, 2022 (Politico).

Pelosi received a warm welcome in Taiwan. Crowds gathered to welcome her, and messages of support were displayed on Taipei's tallest building (Taipei 101)(CFR). Taiwan’s openness to her visit further demonstrates the public opinion agenda set by the DPP and its allies.

During her visit, she met with high-profile officials and semiconductor leaders, such as Morris Chang, Founder of TSMC, to potentially push for further offshoring of Taiwan’s industry (Politico).

Ironically, Morris Chang criticized her and the U.S.’ ambition to move semiconductor manufacturing to the U.S., labeling it as "naive" (Politico). He emphasized the need for continued investment in Taiwan's security to ensure a reliable supply of semiconductors (Formosa News).

The visit was a major turning point for US-Taiwan relations, at least in the eyes of the public. Highlighting the deepening U.S. commitment to Taiwan's democracy while simultaneously provoking China, it continues to catalyze a series of international and domestic shifts shaping the region's dynamics.

For instance, the visit led to an influx of foreign delegations to Taiwan, indicating broader international backing for the island. Despite Beijing's threats and military posturing, countries such as Japan and Lithuania dispatched prominent delegations in the following months (The Guardian).

2024 Presidential Election: A DPP Victory

In January 2024, Taiwan elected William Lai, the former vice president and a member of the Democratic Progressive Party (DPP), as its new president.

Beijing perceives Lai as a stronger proponent of Taiwanese independence than his predecessor, Tsai Ing-wen, heightening concerns on the Mainland.

Lai is expected to maintain the DPP's stance on cross-strait relations, emphasizing Taiwan's sovereignty and resisting Beijing's push for reunification under the "One Country, Two Systems" model.

This approach will likely continue to strain relations with China, which views the DPP's policies as a significant obstacle to its reunification goals.

However, the DPP secured only 40.05% of the vote and lost the legislature, resulting in a hollow victory for an unprecedented third consecutive term in office (CSIS).

The narrow margin compared to previous elections, along with the fact that the majority (~60%) did not want Lai as president, demonstrates the increasing divisions in Taiwan’s politics (Focus Taiwan).

Revisiting the Opposition Implosion (KMT-TPP Debacle)

In the early stages of the election campaigns, a potential KMT-TPP Presidential ticket raised hopes of easing tensions with China, as KMT adheres to the 1992 Consensus and TPP’s Ko Wen-Je aims to maintain cross-strait relations.

Polls indicated that a combined KMT-TPP ticket could have posed a formidable challenge to the DPP by presenting a united front favoring more pragmatic and less confrontational policies (The Diplomat).

Officially, the potential alliance between KMT and TPP fell apart due to disagreements over the primary process and the allocation of roles within the ticket.

However, a closer examination of the collapse of KMT-TPP revealed internal divisions within TPP, and speculation remains about U.S. pressure from the American Institute of Taiwan (AIT).

Ko Wen-je openly stated that the AIT contacted him to inquire whether the CCP was involved in the potential KMT-TPP alliance (Taiwan News).

Moreover, TPP had been in regular contact with the American Institute in Taiwan (AIT), discussing various issues and ensuring that Taiwan-US relations followed the principle of "no surprise" (Taiwan News).

Frequent communication between Taiwan’s political entities and the U.S. highlights the U.S.' commitment to maintaining stability and transparency in Taiwan's political landscape.

This led to the KMT having a weaker position in the presidential race and prevented any DPP opposition from securing a majority.

Legislative Deadlock

Despite winning the presidency, the DPP lost its absolute majority in the Legislative Yuan, securing only 51 out of 113 seats. This loss reflects voter fatigue and a desire for checks and balances on the ruling party.

The Kuomintang (KMT) gained 14 seats, bringing its total to 52 and making it the largest party in the legislature. Nevertheless, the KMT is still short of a majority.

Meanwhile, the TPP positions itself as a potential kingmaker in the legislature, increasing its seats from 5 to 8.

Regardless of the faction's victories, the division in Taiwan's politics only serves to strengthen the CCP's determination on the Mainland and weaken Taiwan's unified front.

With no party holding an outright majority, the DPP will need to negotiate with other parties, especially the TPP, to pass legislation and implement its policies.

A divided legislature will hamper Taiwan’s ability to react to rapidly changing geopolitical realities, playing right into the hands of foreign powers.

Conclusion: The Grey Area Between War & Peace

The situation in Taiwan has become increasingly precarious since "The Economist" highlighted its dangers in 2021.

The election of pro-independence leader William Lai, continued military posturing by China, and the complex dynamics of U.S.-China relations all contribute to a volatile environment.

To achieve stability in the Taiwan Strait, a multidimensional approach addressing economic, political, and cultural factors is necessary.

The path to peace also involves addressing the concerns and interests of all parties involved, as we will discuss in the next and final part of this series.

More importantly, if the people of Taiwan truly desire autonomy or maintenance of their current democratic freedoms—the status quo—then they would do well to avoid falling into a black-and-white trap between the pro-China and pro-West camps.

Amid ongoing US-China tensions, the Democratic Progressive Party (DPP) exacerbates the situation, causing middle-class citizens and youth to bear the brunt of geopolitical maneuvering.

Post Preview[Coming Soon][Final Part]:

Taiwan: The Window For War & A Path To Peace

The increased media attention from The Economist and subsequent coverage, in addition to Pelosi’s visit to Taiwan, has only led to further destabilization of the region.

Mainland China feels increasingly threatened and pressured to ramp up actions to assert its dominance in the region with destabilizing shows of force.

There are only so many times a boy can call a wolf before the wolf comes knocking to blow the house of cards down…

One of my questions is: why is TSMC (as Taiwanese company) trying to establish factories in other parts of the world? Doesn‘t that risk their Taiwan operations, as they are basically offshoreing their ops? Or is that exactly the goal, ie TSMC wants to survive outside Taiwan in the worst case?